The accrual method matches revenue earned with expenses incurred to generate the revenue, which presents a clear picture of company profit. Choose your accounting method: accrual or cash basisīusiness owners should use the accrual basis of accounting so that their financial statements are clear and accurate. If you’re managing your business with the single-entry method, a CPA can help you move to the double-entry method.ģ. When you write a check, you post one transaction that reflects a decrease in your bank balance.īusiness owners should not use the single-entry option because they can’t generate the account activity required to create balance sheets or cash flow statements. Posting activity to your checkbook is a single-entry accounting system. This accounting method records one entry to one account for each transaction. On the other hand, the single-entry method of accounting presents a distorted view of business results. However, the number of debit and credit entries may differ.

BASIC SMALL BUSINESS BOOKKEEPING SOFTWARE

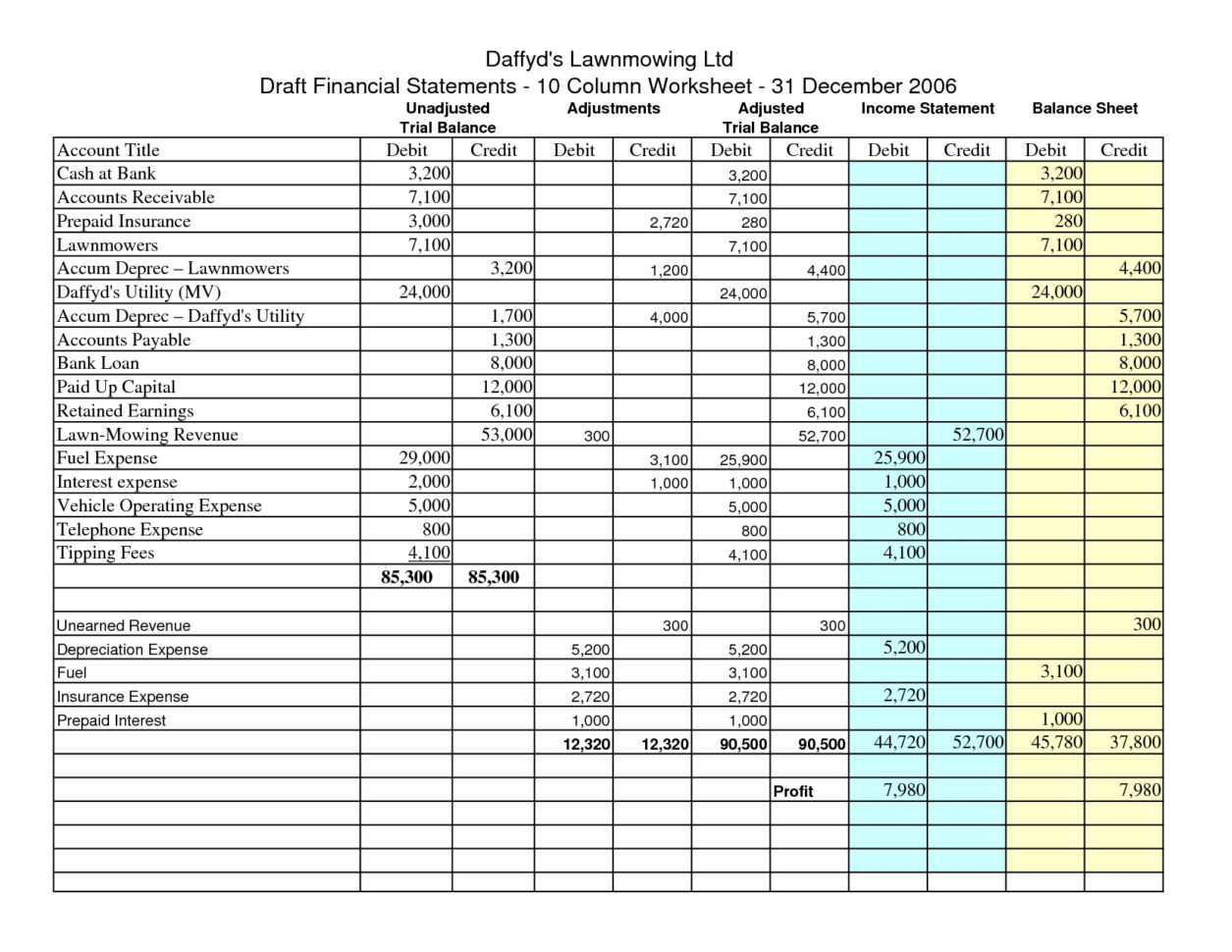

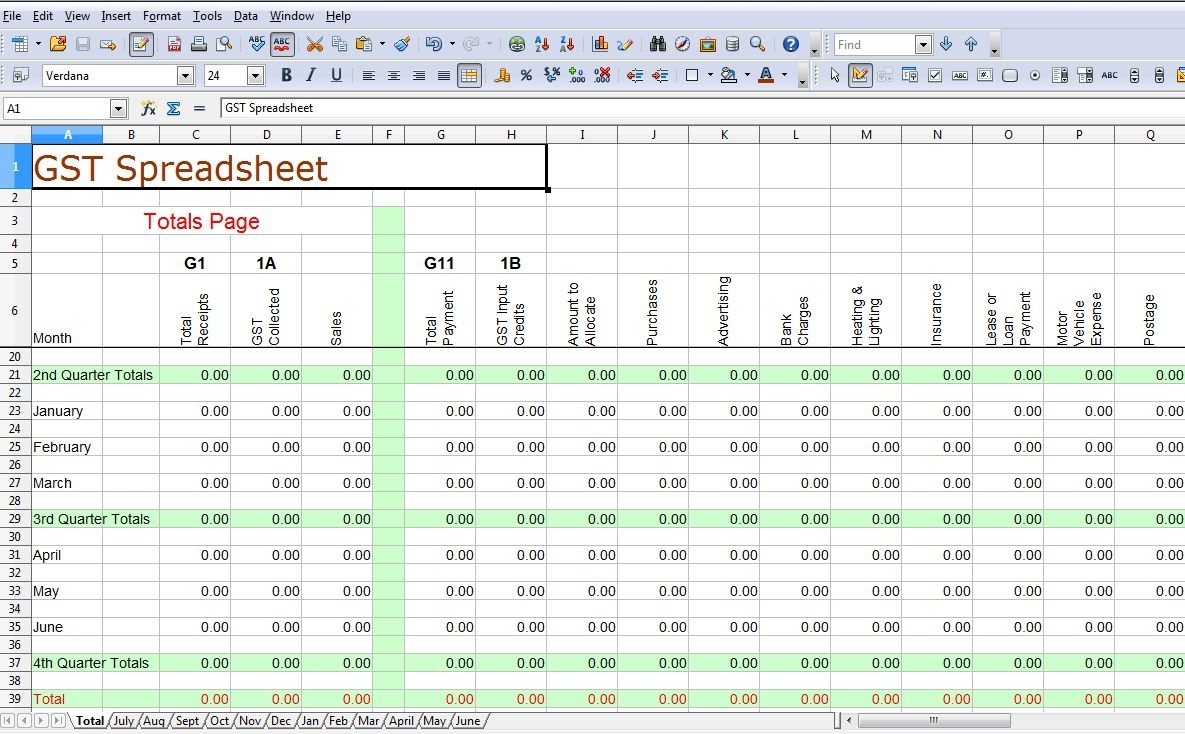

Accounting and bookkeeping software requires each journal entry to post an equal dollar amount of debits and credits. Finally, the total dollar amount of debits must always equal credits. In most cases, liability and revenue accounts increase with a credit entry. Credit entries are on the right side of each journal entry. In most cases, asset and expense accounts increase with each debit entry. And when it’s time to post a journal entry to your accounting system, the double-entry method accounts for debit entries, credit entries, and totals.ĭebit entries are on the left side of each journal entry. Using the double-entry method, you can get a clearer picture of your business activity. This concept is important because each accounting transaction impacts at least two accounts. Choose a bookkeeping method: double-entry or single-entryĮvery business should use the double-entry bookkeeping method. The expenses in the income statement won’t be accurate, and your business tax return will contain errors.Ģ. Let’s assume that you post $2,000 in personal expenses in the company accounting records. If you post business and personal transactions in the same bookkeeping system, you risk the accuracy of your financial statements and tax returns. If your business is a corporation, for example,it should be a legal entity separate from you. Separating your expenses can protect your personal assets from business liability or a lawsuit. Activity in the business account should not include any personal expenses. Open a bank account using your company name and tax identification number. Separate your business and personal expenses And if you make a mistake, you’ll be able to correct it much faster.ġ. When you have a reliable system, you post fewer errors. Your business may post dozens of accounting transactions each week. You can use accounting transactions to generate balance sheets, income statements, and cash flow statements. Your lender will require accurate financial statements to fund your loan.

Using basic bookkeeping principles, you can post and access information that managers need to make decisions.īookkeeping can help you finance your businessĮventually, your business may need to borrow money to operate. Managers need accurate data to increase sales, manage costs, and to oversee cash flow. If the data is incomplete or contains errors, you’ll have to amend the returns, which may result in interest and penalties.īookkeeping can help you make management decisions Using bookkeeping, you can record revenue and expenses and generate tax returns. Proper bookkeeping can help you provide much of that data.īookkeeping can help you manage tax filings Investors, creditors, vendors, and regulators need accurate financial records regarding your business. To understand the importance of bookkeeping, think about your company’s stakeholders.

0 kommentar(er)

0 kommentar(er)